Define Marketing ROI a Guide for Modern DTC Brands

Jan 20, 2026

Marketing Return on Investment (ROI) is the ultimate financial report card for your marketing efforts. It cuts through the noise of clicks, likes, and impressions to answer one simple, brutal question: is this campaign actually making us money?

For any direct-to-consumer (DTC) brand trying to grow sustainably, getting a handle on ROI isn't just a good idea—it's everything.

What Is Marketing ROI and Why It Matters for DTC

If you think of your ad campaigns as employees, ROI is their performance review. It’s the metric that tells you which campaigns earned a raise and which ones need to be let go.

Metrics like Return on Ad Spend (ROAS) are great for a quick pulse check, but they only show revenue, not profit. ROI goes deeper. It measures the actual profitability of your marketing spend, telling you the real story of what's working.

Marketing ROI, or MROI, is the profit you earn from your marketing activities compared to what you spent on them. The classic formula is (Revenue Generated from Marketing - Cost of Marketing) / Cost of Marketing. It's usually shown as a percentage and gives you a clear picture of your efficiency. For a deeper dive, Sprinklr.com offers more detailed insights on this core metric.

The Strategic Value of MROI

For DTC founders and performance marketers, a sharp focus on MROI is a massive strategic advantage. It shifts the conversation from vanity metrics to what really matters: the bottom line. It forces a disciplined, almost surgical approach to how you spend every single dollar.

Here's why getting it right is so critical:

Allocate Budgets Confidently: You can stop guessing. With clear ROI data, you know exactly which channels and campaigns are driving real profit, so you can confidently double down on your winners.

Drive Sustainable Growth: It's easy to buy revenue, but profitable growth is another story. ROI ensures you aren't just lighting cash on fire to scale, building a much more stable and resilient business.

Justify Marketing Spend: ROI lets you speak the language of the C-suite and investors: profit and loss. It's how you prove that marketing isn't just a cost center—it's a profit engine.

Identify True Winners: Sometimes the ad with the most clicks isn't the one making you the most money. ROI helps you uncover the creative, audiences, and offers that truly move the needle on your P&L.

At its core, ROI connects your marketing actions directly to business health. It’s the bridge between campaign data and your profit and loss statement, making every decision accountable to the bottom line.

Ultimately, mastering marketing ROI is about making every dollar count. It's the bedrock for building a DTC brand that can do more than just survive—it can thrive by making smarter, data-backed decisions that protect your profitability.

How to Calculate Marketing ROI With Real Examples

Calculating your marketing ROI isn't some abstract theory—it's simple math that tells you whether your campaigns are actually making money. If you're serious about growing your e-commerce brand sustainably, you have to move past the vanity metrics.

Let's walk through the exact formulas you need, starting with the basic one and building up to the calculations that give you the full financial story. We'll use a simple, real-world scenario to make it crystal clear.

Scenario: A DTC brand spends $5,000 on a Meta Ads campaign. This campaign brings in $25,000 in revenue. The cost of goods sold (COGS) for those products is $10,000.

The Standard Revenue-Based Formula

This is the one you see most often. It's a quick, back-of-the-napkin calculation that pits your revenue against your ad spend. But be warned: while it's simple, it can give you a dangerously rosy picture of performance because it completely ignores the cost of your products.

Formula:

(Revenue - Marketing Cost) / Marketing CostExample Calculation:

($25,000 - $5,000) / $5,000 = 4

In percentage terms, that’s a 400% ROI. Looks incredible, right? For every dollar you put in, you got four dollars back in sales. But did you actually profit? Let's find out.

The Gross Profit ROI Formula

To get one step closer to reality, you have to factor in the cost of the products you sold. This formula peels back a layer to show your return after you've paid for the inventory. This gives you a much more honest signal of a campaign's profitability.

Formula:

((Revenue - COGS) - Marketing Cost) / Marketing CostExample Calculation:

(($25,000 - $10,000) - $5,000) / $5,000 = 2

Now we're looking at a 200% ROI. It’s still a solid return, proving the campaign was profitable even after accounting for the ads and the product costs. Getting this number right hinges on clean data, which is why understanding how to properly use UTMs for Google Analytics is so important to make sure you're tying revenue to the right source.

The Net Profit ROI Formula

Here it is—the moment of truth. This is the formula that tells you what really happened. Net Profit ROI factors in all the associated business expenses, not just ad spend and COGS. We’re talking about shipping, payment processing fees, software, and maybe even a slice of your team's salaries.

Let’s add $5,000 in these other overhead costs to our scenario.

Formula:

((Revenue - COGS - Overhead) - Marketing Cost) / Marketing CostExample Calculation:

(($25,000 - $10,000 - $5,000) - $5,000) / $5,000 = 0

The result? A 0% ROI. The campaign broke even. Suddenly, what looked like a massive 400% win is exposed as a campaign that added zero actual profit to the business once all was said and done.

This journey from 400% to 0% highlights a classic trap for DTC brands: a campaign can generate a ton of revenue and still be completely unprofitable. By graduating from a simple revenue-based calculation to a net profit model, you get an honest look at what’s truly driving your bottom line.

Understanding ROI, ROAS, CAC, and LTV

Performance marketing is a world of acronyms. If you've been in the trenches, you know how often they get thrown around—and misused. Getting them wrong isn't just a matter of semantics; it leads to bad strategic calls that can really hurt your bottom line.

To get a real grip on marketing ROI, we first need to get crystal clear on how it differs from its close cousins: Return on Ad Spend (ROAS), Customer Acquisition Cost (CAC), and Customer Lifetime Value (LTV).

Think of these as different lenses for viewing your business. Each one gives you a unique perspective, and trying to use one when you need another is like using a microscope to look at the stars. You won't see what you need to, and you’ll likely come to the wrong conclusions.

ROI vs. ROAS: The Big Picture vs. The In-the-Moment Read

The most common mix-up by far is between ROI and ROAS. They sound alike, but they answer fundamentally different questions about your marketing's performance.

Return on Ad Spend (ROAS) is all about tactics. It’s the metric you live and breathe inside your ad platforms. ROAS gives you an immediate report card, telling you how much raw revenue you're generating for every single dollar you spend on ads. It's a simple calculation: Revenue / Ad Spend. This makes it perfect for quick, in-the-weeds decisions, like knowing when to pour more budget into a winning ad set.

Marketing ROI, however, is a strategic metric. It zooms out to look at overall profitability. This calculation goes deeper, factoring in all the costs tied to getting a product into a customer's hands—the cost of the goods themselves (COGS), shipping, fulfillment, and even a portion of your team's salaries. ROI tells you if your entire marketing machine is actually profitable, not just driving top-line revenue. It's entirely possible to have a killer ROAS that masks an unprofitable campaign once all the real costs are tallied up.

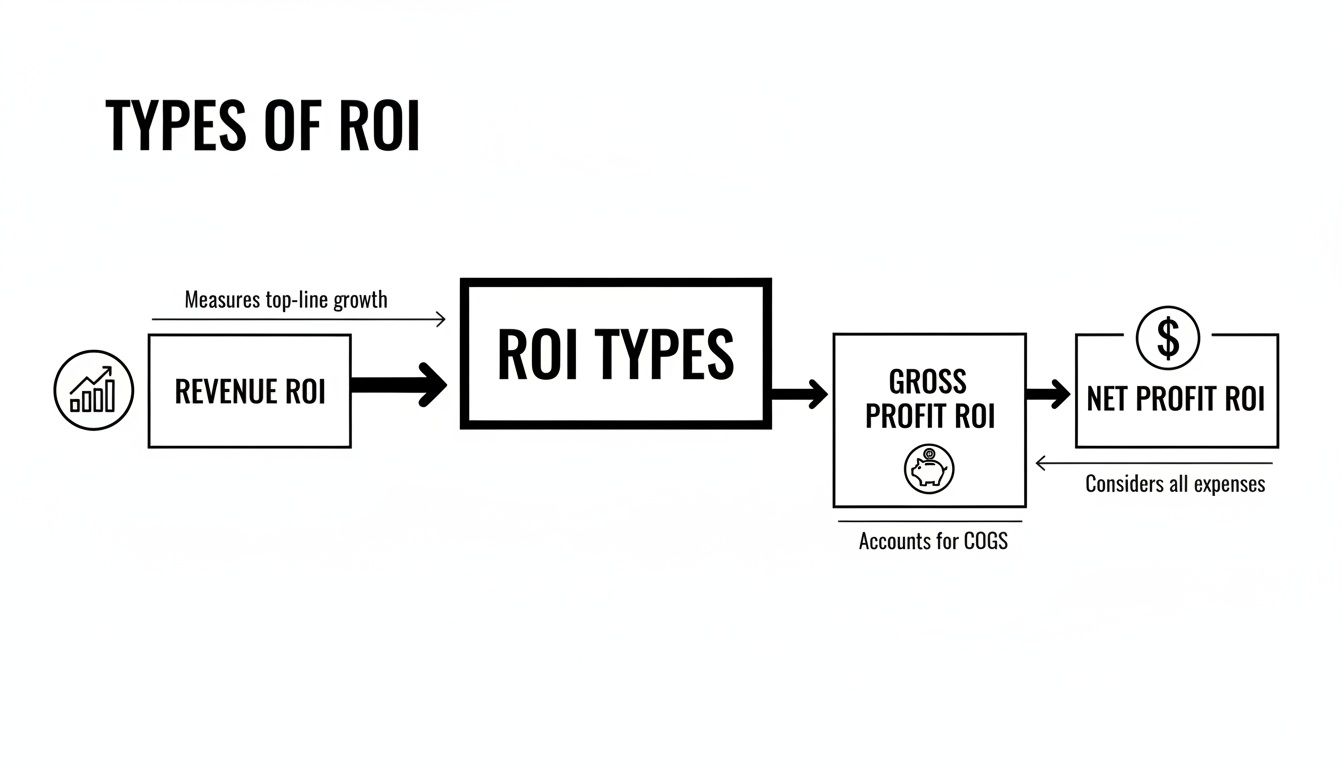

This is why we talk about different "levels" of ROI. You can start with a basic revenue-based view, but the real story comes from a net profit perspective.

As you can see, moving from a simple Revenue ROI to a comprehensive Net Profit ROI gives you a much truer picture of your marketing's financial health.

CAC and LTV: The Twin Engines of Sustainable Growth

While ROI and ROAS are backward-looking metrics, telling you what just happened, Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV) are forward-looking. They help you predict and build long-term, sustainable growth.

Customer Acquisition Cost (CAC): Put simply, this is what it costs you, on average, to get a brand new customer in the door. You calculate it by dividing your total marketing and sales spend over a set period by the number of new customers you acquired during that time.

Customer Lifetime Value (LTV): This metric forecasts the total profit you expect to make from an average customer over the entire time they do business with you. It’s the long-term prize.

A healthy, scalable business model demands that your LTV is significantly higher than your CAC. The gold standard is a ratio of at least 3:1. If your CAC is higher than your LTV, you’re literally paying to lose money on every new customer you bring in.

To help clarify how these four critical metrics fit together, here’s a quick-glance comparison:

ROI vs. ROAS vs. CAC vs. LTV

This table breaks down the four horsemen of performance marketing metrics, showing what they measure and when to use them.

Metric | Formula | What It Tells You | Strategic Use |

|---|---|---|---|

Marketing ROI |

| The overall profitability of all your marketing efforts. | Making high-level budget allocation and strategic planning decisions. The ultimate measure of marketing's contribution to the bottom line. |

ROAS |

| How much revenue is generated for every dollar spent on a specific ad platform or campaign. | Optimizing ad campaigns in real-time. A tactical metric for media buyers to scale winners and cut losers. |

CAC |

| The average cost to acquire a single new customer. | Setting efficiency targets for acquisition channels and understanding payback periods. |

LTV |

| The total projected profit from a single customer over their lifetime with your brand. | Justifying marketing spend, informing customer retention strategies, and predicting long-term business health. |

As you can see, these metrics don't compete; they complement each other. ROAS helps you win the daily battles in your ad accounts. CAC sets the target for what you can afford to pay for a customer. LTV shows you what that customer is truly worth over the long haul, and ROI is the final judge of whether your entire growth strategy is actually working.

Understanding this interplay is non-negotiable, especially when you’re figuring out how to scale Facebook ads without burning through your cash.

Common Pitfalls in Measuring Marketing ROI

If you think measuring marketing ROI is just about plugging numbers into a formula, think again. Even seasoned marketing teams can fall into common traps that lead to bad decisions, wasted budgets, and stalled growth. It’s like trying to navigate a new city with a map that's missing half the streets—the strategic moves you make will only be as reliable as the data you're using.

Measuring ROI has come a long way from simple tracking to today's complex attribution models. Yet, the challenge remains very real. A recent Nielsen report revealed that in 2023, only 26% of global marketers felt "fully confident" in their metrics. That’s a huge gap in confidence. You can read the full Nielsen report findings here.

Getting this right means learning to spot the traps that can completely distort the picture of your performance.

Over-Relying on Flawed Attribution Models

The single biggest pitfall I see is relying too heavily on overly simple attribution models, especially last-click. It's easy to track, sure, but it gives 100% of the credit to the very last thing a customer did before buying. What about the podcast they heard, the blog post they read, or the social ad that first put your brand on their radar? Last-click ignores all of it.

This creates a dangerously skewed view of what’s actually working. It systematically overvalues channels that close the deal (like branded search) and undervalues the top-of-funnel efforts that created the demand to begin with. You need a more holistic view, whether that’s through a multi-touch model or at least by digging into assisted conversions to see the full customer journey.

Ignoring Hidden Costs

A campaign that looks great on paper can quickly become a money-loser once you factor in all the hidden expenses. A true ROI calculation has to include every cost, not just what you paid for the ads.

These are the costs people almost always forget:

Creative Production: The money you spent on photographers, designers, copywriters, and video editors.

Agency or Freelancer Fees: Those monthly retainers and project fees for your external partners.

Software and Tools: The subscriptions for your analytics platforms, design tools, or schedulers.

Team Salaries: A portion of your marketing team’s time dedicated to running that specific campaign.

If you leave these out, you end up with an inflated ROI that doesn't reflect your actual profitability.

A campaign’s success isn't defined by high revenue, but by its contribution to your net profit. If your ROI calculation ignores key costs, you're operating with a blindfold on, mistaking activity for progress.

Chasing Short-Term Gains

Another classic mistake is obsessing over short-term results at the expense of long-term brand health. Making reactive, knee-jerk decisions based on a single day's data is a great way to kill a perfectly good campaign.

Marketing performance isn't a straight line; it has its ups and downs. Killing a campaign after one bad day or pouring money into it after one great day is just emotional decision-making. True ROI analysis means looking at trends over a meaningful period—at least a week, but more likely a month—to make strategic choices that build sustainable, long-term growth.

Actionable Strategies to Improve Your Marketing ROI

Knowing how to calculate your marketing ROI is just the starting line. The real work—and where the best operators shine—is in building a system that consistently makes it better. It's about turning your marketing spend into a predictable profit engine.

Let's move past the generic advice. Here are some practical, in-the-trenches tactics that actually move the needle for DTC brands and their performance teams.

Double Down on High-Performing Channels

Your fastest path to a better overall ROI is to find what’s already working and pour fuel on the fire. Don't fall into the trap of spreading your budget thinly across every platform just to be everywhere. Your own data is your best guide.

If Meta Ads are crushing it with a 300% ROI, but Google Shopping is lagging at 150%, your next available dollar should go straight to Meta. This simple, data-led approach forces you to stop funding underperforming channels out of habit and start making objective decisions based on what’s actually hitting your bottom line.

Treat your marketing budget like a performance-based investment portfolio. You wouldn’t keep sinking money into an underperforming stock, so don’t do it with your ad channels. Relentlessly shift capital from low-return assets to your high-growth winners.

Systematically Test Creative and Audiences

Within any given channel, your ad creative and audience targeting are the two biggest levers you can pull to improve ROI. But "testing" doesn't mean throwing random ideas at the wall. You need a structured framework to find what truly resonates.

Test One Variable at a Time: Want to know if a new headline works? Then only change the headline. Keep the image, body copy, and audience identical. This isolates the variable and gives you clean, undeniable data on what caused the performance shift.

Focus on Big Swings: Don't get bogged down testing fifty shades of blue on your call-to-action button. Instead, test completely different value propositions, ad formats (like video vs. static), or creative concepts. This is where you find real breakthroughs, not just tiny incremental gains.

Let the Data Decide: It’s tempting to call a winner after a day or two, but don't. Let your tests run long enough to reach statistical significance. A true winner is one that holds up over time with a meaningful amount of data behind it.

A disciplined testing process removes the guesswork. Over time, you build a library of proven creative angles and audience segments you can lean on as you scale your spend.

Optimize Your Conversion Funnel

Driving traffic is only half the job. You can have the best ad campaign in the world, but if it sends people to a slow, confusing, or untrustworthy landing page, you’re just lighting money on fire. Every click that doesn’t convert is wasted ad spend that drags down your ROI.

Put serious effort into optimizing the post-click experience. Improving your site's conversion rate makes every single ad dollar you spend more efficient. A crucial first step in that journey is getting the click itself. For a deep dive, check out our guide on how to improve click-through rate.

Leverage Retention to Increase LTV

This is the one most marketers overlook, but it’s a total game-changer. It’s almost always cheaper to get a current customer to buy again than to acquire a brand new one. By increasing your Customer Lifetime Value (LTV), you make your initial acquisition cost far more profitable in the long run.

Think about it: the more value you extract from each customer, the more you can afford to spend to acquire them in the first place, giving you a massive competitive edge. Email and SMS marketing are your best friends here. Industry benchmarks consistently show email marketing delivering an insane ROI, averaging $36 to $42 for every $1 spent. It’s an absolute powerhouse for building relationships and driving the repeat purchases that supercharge your total marketing ROI.

Frequently Asked Questions About Marketing ROI

Alright, we've covered the formulas and the high-level strategy. But when the rubber meets the road, things can get messy. DTC operators and marketing managers are always wrestling with the same practical questions.

Let's dive into some of the most common ones I hear and get you some clear, no-fluff answers.

What Is a Good Marketing ROI for an E-commerce Business?

This is the million-dollar question, isn't it? The honest answer is, it depends entirely on your profit margins. You’ll often hear a 5:1 ratio (that’s a 400% ROI) thrown around as a great benchmark, but chasing a generic number like that can be a fast track to ruin.

Think about it. A luxury brand selling high-margin, handcrafted leather goods might be printing money with a 3:1 ROI. But a DTC brand in the competitive CPG space, with razor-thin margins on their products, might need to hit a 10:1 ratio just to break even.

Your north star isn't some industry average; it's your own break-even point. Before you worry about what’s “good,” calculate the exact ROI you need to actually be profitable. From there, your only goal is to consistently beat your own baseline.

How Often Should I Calculate and Review Marketing ROI?

You need to operate on two different clocks: one for quick tactical checks and another for deeper strategic thinking.

Daily or Weekly (The Tactical Pulse-Check): For channels that move at the speed of light, like Meta or Google Ads, you've got to be in there daily or at least weekly. This is where you're looking at metrics like ROAS, CPA, and CTR to make quick adjustments—maybe you pull back a bit of budget from a dud ad or double down on a winner.

Monthly or Quarterly (The Strategic Review): The real, profit-driven ROI calculation needs a longer view. Doing this monthly or quarterly smooths out all the daily noise and gives you a much more stable picture of what's actually working. This timeframe accounts for things like delayed purchases, customer returns, and longer sales cycles. It's this data that gives you the confidence to make big strategic moves, like shifting a major chunk of your budget from one channel to another.

How Do I Measure ROI for Harder-to-Track Channels?

Ah, the classic brand-building dilemma. How do you measure the ROI of your organic social, your blog, or your brand awareness campaigns? You can't always draw a neat line from a TikTok video to a sale, but that doesn't mean it's impossible to measure. The trick is to use a mix of direct and indirect signals.

First, track what you can. Always use UTM parameters on any links you share in your content. This will at least capture the people who clicked and converted right away, giving you a baseline for direct revenue.

Next, you have to play detective and look for influence. Dive into Google Analytics and check out "assisted conversions." This report shows you how many times your content or social channels were a touchpoint in a customer journey that eventually led to a sale, even if they weren't the last click.

Finally, keep an eye on the leading indicators—the proxy metrics that tell you the top of your funnel is getting stronger. Are you seeing a lift in:

Branded Search Volume: Are more people typing your brand name directly into Google?

Direct Traffic: Is your direct traffic (people typing your URL into their browser) on the rise?

Email Sign-ups: Is your content successfully turning casual readers into engaged subscribers?

You might not get a perfect, clean ROI figure for these channels. But by blending these different data points, you can build a very strong, data-supported case for their value in driving long-term growth.

At SpendOwlAI, we know that moving from theory to execution is the hardest part. Our system is designed to cut through the noise of ad performance and give you clear, prioritized actions for managing Meta, Google, and Shopify. We don't just show you data; we tell you what to change—and what to leave alone—to protect your bottom line. Start your free 7-day trial and execute with confidence every day.