Your Guide to Mastering Cost Per Acquisition for E-commerce

Jan 20, 2026

Cost Per Acquisition, or CPA, is one of those bedrock metrics in advertising. Simply put, it's what you pay to get someone to take a specific action because of your ad—whether that's making a purchase, signing up for a newsletter, or downloading an app. It directly answers the most important question for any campaign: "Is this ad actually making me money?"

What Cost Per Acquisition Really Means for Your Business

Think of it like this: if you own a food truck, your CPA is the cost of the ingredients and the gas it takes to sell one burrito. If that cost is higher than the price of the burrito, you're losing money on every sale. That’s the brutal honesty of CPA. For any performance marketer or e-commerce brand, it's the ultimate test of a campaign's financial health.

Keeping a close eye on this number has never been more critical. The cost to get a customer through the door has skyrocketed, jumping a staggering 222% in just eight years. An action that cost you $1.00 back in 2016 now demands around $3.22, a spike fueled by intense competition on ad platforms and new privacy rules. You can find more data on these rising costs in this report from Genesys Growth.

Distinguishing CPA from Other Key Metrics

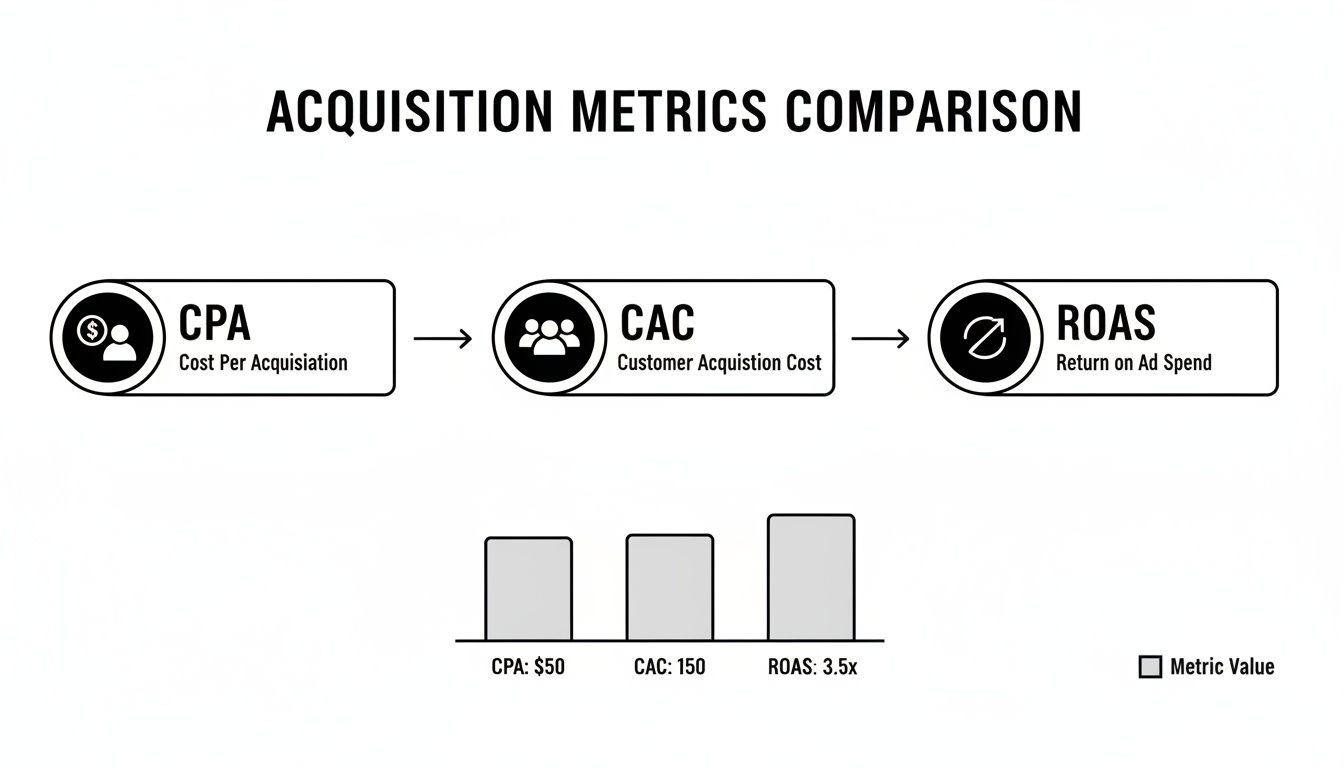

To get a true read on your business, you have to know the difference between CPA and its close cousins, Customer Acquisition Cost (CAC) and Return on Ad Spend (ROAS). Mixing them up is a common mistake that leads to bad budget calls and a warped view of your performance.

Let's quickly break them down.

Here’s a simple table to keep these straight:

Key Acquisition Metrics at a Glance

Metric | What It Measures | Formula | Best Used For |

|---|---|---|---|

Cost Per Acquisition (CPA) | The cost to get a single action (e.g., sale, lead) from a specific campaign. | Total Ad Spend / Total Conversions | Optimizing ad campaigns and channels for efficiency. |

Customer Acquisition Cost (CAC) | The total cost to acquire a brand-new customer across all marketing and sales efforts. | (Total Marketing + Sales Costs) / # of New Customers | Assessing the overall profitability and scalability of your business model. |

Return On Ad Spend (ROAS) | The revenue generated for every dollar of ad spend. | Total Revenue from Ads / Total Ad Spend | Measuring the direct revenue impact and profitability of your ad campaigns. |

In short, CPA is your tactical, in-the-trenches metric for specific ads. CAC gives you the big-picture, business-level health check. And ROAS tells you how much cash your ads are bringing back in.

While CPA measures the cost of a conversion, ROAS measures the revenue it generated. You can have a fantastic, low CPA, but if the average order value is tiny, your ROAS might be terrible. That’s why you need both to see the full picture.

Why CPA Is the Foundation of Growth

Getting a handle on your CPA isn't just a numbers game—it’s the key to making smart decisions that build a sustainable business. It keeps your profitability in check by making sure you don't spend more to land a customer than that customer is actually worth to you.

When you track CPA at a granular level—by campaign, ad set, or even individual creative—you can instantly spot what's working and what's burning cash. This lets you shift your budget away from the duds and double down on the winners, squeezing maximum value out of every single dollar you spend. At the end of the day, a well-managed CPA is the engine that drives a profitable advertising strategy.

Calculating and Benchmarking Your CPA with Confidence

Knowing your Cost Per Acquisition is one thing. Nailing the calculation and truly understanding what it means for your business? That's where the real magic happens.

At its heart, the formula seems simple enough, but this is exactly where a lot of marketers get tripped up, leading to skewed data and, ultimately, wasted ad spend.

The Basic CPA Formula

Let’s start with the fundamentals. The calculation itself is straightforward:

CPA = Total Ad Spend / Total Conversions

So, if you spend $5,000 on a Google Ads campaign for a new sneaker launch and it brings in 100 sales, your CPA is $50. Simple. That number tells you exactly what it cost to get one customer from that specific campaign.

However, a classic rookie mistake is just taking the numbers your ad platforms spit out at face value. You have to make sure you're comparing apples to apples—that means using the same date ranges and attribution windows across all your analytics tools.

This breakdown shows how CPA fits in with other crucial acquisition metrics. It’s not just about one number; it’s about seeing the whole picture.

As you can see, CPA is your campaign-level efficiency gauge. It works hand-in-hand with broader metrics like Customer Acquisition Cost (CAC) and Return on Ad Spend (ROAS) to give you a clear view of your business's financial health.

So, What's a "Good" Cost Per Acquisition?

Once you have a reliable number, the next question is always, "Is my CPA any good?" The honest answer? It depends.

There's no universal "good" CPA. A good CPA is one that's profitable for your business, with your margins, in your industry.

Think about it: a $100 CPA would be a total disaster for a brand selling $80 shoes. But for a company selling $1,000 smart fridges? That's a home run. The real test is how your CPA stacks up against your profit margins and, ideally, your customer lifetime value (LTV).

Here's a solid rule of thumb: Make sure your CPA is lower than the gross profit from a customer's first purchase. If your average order is $120 and your margin is 40% ($48 profit), any CPA under $48 means you're making money from day one.

Understanding Industry and Channel Benchmarks

While your own profitability is the North Star, looking at external benchmarks gives you a reality check. They help you see how you're doing against the competition and set realistic goals for different channels.

For example, you can't expect the same CPA from Google Search, where someone is actively looking for what you sell, as you would from a Meta ad, where you're trying to grab their attention while they scroll through photos.

The variance is huge. You can see more details on these average customer acquisition costs and their drivers, but costs can range from $70 in e-commerce to a staggering $1,450 in fintech. In specialized fields, it gets even more intense: insurance companies might pay an average of $1,280 per customer, while some project management software companies are spending $891 to get a single sign-up.

To bring this to life for e-commerce, I’ve put together a table with some sample CPA benchmarks.

Example CPA Benchmarks by E-commerce Niche and Channel

This table provides some illustrative Cost Per Acquisition benchmarks for common e-commerce categories across popular advertising channels, helping marketers set realistic performance targets.

E-commerce Niche | Google Search CPA Range | Meta Ads CPA Range | TikTok Ads CPA Range |

|---|---|---|---|

Apparel & Fashion | $40 – $90 | $25 – $60 | $20 – $50 |

Home Goods | $60 – $150 | $50 – $120 | $40 – $95 |

Consumer Electronics | $80 – $350+ | $100 – $300+ | $90 – $250+ |

Beauty & Cosmetics | $35 – $80 | $20 – $55 | $15 – $45 |

These numbers are just a guide, of course. Your own brand recognition, creative quality, and targeting precision will play a massive role in where you land within these ranges.

Ultimately, just calculating your CPA is step one. The real work starts when you benchmark that number—against your own profitability and the wider market—to turn raw data into smart, profitable decisions.

Five Levers for Systematically Reducing Your CPA

Knowing your Cost Per Acquisition is the starting line. Actually reducing it, day in and day out, is how you build a profitable advertising machine. A high CPA is rarely a single, glaring problem; it's usually the result of small leaks and inefficiencies scattered across your campaigns.

The trick is to view your advertising strategy as a system with five distinct levers you can pull. This isn't about random tweaks or chasing shiny objects. It’s a methodical, data-driven approach. By focusing on these five core areas, you can systematically plug those leaks, drive down costs, and make every ad dollar work harder.

1. Powerful Creative Optimization

Your ad creative is the tip of the spear. In a sea of content, it’s your first—and often only—shot at grabbing someone's attention. If your creative is stale, bland, or just doesn't connect, your CPA will pay the price.

Let's be blunt: no amount of sophisticated targeting or bidding wizardry can salvage a boring ad. Your one and only job here is to stop the scroll and earn that click. That means getting into a rhythm of relentlessly testing creative elements to find out what truly resonates.

Here are a few high-impact tests to run:

Video Hooks: Your first 3 seconds are everything. Try opening with a question, a shocking visual, or a creator looking directly at the camera. See what stops thumbs most effectively.

Ad Formats: Don't get stuck on static images. Pit them against user-generated content (UGC), slick studio shots, carousels that break down product benefits, and short-form video reels.

Copy Angles: Test different ways of framing the value. One ad might focus on product features, another on an emotional outcome, and a third on solving a very specific pain point.

2. Intelligent Audience Targeting

Burning cash on the wrong audience is the quickest way to inflate your CPA. Great targeting isn't about reaching the most people; it's about reaching the right people—the ones who are actually likely to buy. This demands a sharp understanding of your ideal customer profile (ICP).

This goes way beyond basic demographics. You need to get inside their heads and understand their interests, online habits, and problems. As you collect more data from your campaigns, you can start to zero in on high-intent segments and, just as importantly, cut out the tire-kickers.

Key Takeaway: An aggressive approach to negative audiences is a seriously underrated strategy. If you sell high-end audio equipment, for instance, excluding users interested in bargain-bin electronics stores can instantly boost your traffic quality and lower your CPA.

By constantly refining who sees your ads, you ensure your budget is spent on clicks that have a real shot at converting. Higher-quality traffic almost always translates to a lower CPA. For a closer look at how click quality affects performance, check out our guide on how to improve click-through rate.

3. Advanced Bid Strategy Management

Just flipping on "Maximize Conversions" and hoping for the best is a rookie move that often leads to a sky-high CPA. While these automated strategies have their place, they lack the financial nuance required for true profitability. To get a real edge, you have to graduate to more advanced, value-based bidding.

Instead of just telling the ad platform to get you conversions at any cost, value-based bidding instructs it to hunt for the conversions that are more valuable to your business. This is absolutely essential for stores with a wide range of product prices.

For example, setting a ROAS (Return On Ad Spend) target forces the platform to optimize for revenue, not just the number of sales. This keeps the algorithm from happily spending $40 to acquire a $30 sale—a common pitfall of basic conversion bidding that can absolutely wreck your bottom line.

4. High-Impact Landing Page CRO

You can have the world's best ad and perfectly dialed-in targeting, but if your landing page drops the ball, all that money and effort go straight down the drain. Your landing page is the final, make-or-break step in the customer journey. Conversion Rate Optimization (CRO) is the lever you pull to make that step as compelling and frictionless as possible.

Even tiny improvements here can have an outsized impact on your CPA. Think about it: if you can double your landing page conversion rate from 2% to 4%, you've just cut your Cost Per Acquisition in half without touching a single ad.

Focus your energy on these areas for the fastest wins:

Page Speed: Every extra second of load time is costing you customers. Compress your images and clean up your code to make your page load instantly, especially on mobile.

Offer Clarity: Can a visitor understand what you sell and why it matters within five seconds of landing? Your value proposition needs to be crystal clear above the fold.

Frictionless Checkout: Get out of the customer's way. Ditch unnecessary form fields, offer a guest checkout option, and provide one-click payment methods like Shop Pay or PayPal.

5. Product-Level Profitability Focus

The final lever requires you to look past campaign-level averages and drill down into product-level profitability. Not all of your products are created equal. Some are high-margin rockstars that drive your business, while others might be low-margin items or have high return rates.

A common mistake is promoting all products with the same level of intensity. The smarter play is to dig into your SKU-level data and identify your "margin heroes"—the products that contribute the most to your actual profit.

By strategically shifting your ad budget toward these high-margin winners, you can afford to pay a little more to acquire those customers while radically improving your overall business profitability. This shifts your focus from just acquiring customers to acquiring profitable customers, which is the only game worth playing in e-commerce.

Avoiding Costly Mistakes in CPA Measurement

Your CPA data is only as good as the context surrounding it. If you're not careful, you can easily be led astray by numbers that look fantastic on the surface but are actually hiding some serious issues. Making big budget decisions based on flawed data is probably the fastest way to torch your ad spend and stall your growth.

The trick is to stop taking your ad dashboards at face value and start asking tougher questions about the story the data is telling. Too many marketers get caught in common traps that lead to knee-jerk, unproductive decisions. Once you know what to look for, you can safeguard your campaigns and build a far more durable advertising strategy.

The Last-Click Attribution Trap

One of the most pervasive—and dangerous—mistakes is putting all your faith in last-click attribution. This model gives 100% of the credit for a sale to the very last ad a customer clicked before they bought something. It's simple, sure, but it paints a picture of reality that's dangerously distorted.

Think about it. A customer might first discover your brand through a TikTok video, get reminded of it with an Instagram retargeting ad a few days later, and then finally type your brand name into Google to make a purchase. In a last-click world, Google gets all the glory. TikTok and Instagram, the channels that actually created the demand, look like they did absolutely nothing.

This consistently undervalues the top-of-funnel channels responsible for introducing new people to your brand. When you optimize everything for a last-click CPA, you inevitably end up cutting the budgets for the very campaigns that fill your pipeline, slowly starving your business of new customers.

To get a more honest view, you need to look at other attribution models.

Linear Attribution: This model is a good starting point. It splits the credit evenly across every touchpoint in the customer's journey, helping you see all the channels that played a part.

Data-Driven Attribution: This is the gold standard. It uses your account’s own historical data to figure out how much credit each touchpoint truly deserves, giving you a much more sophisticated and accurate view of what’s actually driving sales.

Confusing Correlation with Causation

Another expensive mistake is assuming that just because two things happened around the same time, one must have caused the other. This is the classic "correlation doesn't equal causation" problem, and it's everywhere in performance marketing.

For instance, you launch a new ad creative, and your CPA drops by 20% that same week. It’s tempting to declare the new ad a runaway success. But what if that week also happened to be a holiday weekend? Or a competitor’s website went down? Or a new trend suddenly made your product more popular? The dip in your cost per acquisition might have had very little to do with your new ad.

To avoid this trap, you have to think more like a scientist. When you test something new, do your best to isolate that single change. More importantly, look for trends over longer periods instead of reacting to a single good or bad day. Always consider the outside factors before you jump to conclusions.

The Cross-Device Journey Blind Spot

Today’s path to purchase is a chaotic scramble across multiple devices. A customer might see your ad on their phone during their morning commute, research your products on their work laptop at lunch, and finally pull the trigger on their tablet at home that evening.

If your tracking can't connect these dots, each device looks like a completely different user. This shatters your data, making it almost impossible to see the full conversion path and measure your true CPA. This is why solid tracking, like having properly set up UTM parameters, is non-negotiable. You can learn more about using UTMs for accurate analytics to get this right.

By sidestepping these common measurement mistakes, you can build a far more accurate and complete picture of your ad performance. That clarity is what allows you to optimize your budget with confidence and drive truly profitable growth.

Building a Daily System to Manage Your CPA

Stop staring at dashboards and start taking action. The secret to managing your Cost Per Acquisition isn't making frantic, knee-jerk changes every time a number wiggles. It's about building a calm, repeatable daily system that helps you see what truly matters and ignore the noise.

The biggest trap for marketers is getting lost in the daily data swings. One day your CPA looks fantastic; the next it spikes, and panic sets in. Reacting to every little wave often does more harm than good, constantly resetting the ad platform's learning phase and preventing your campaigns from ever hitting their stride.

Think of an effective daily system like a pilot's pre-flight checklist. It’s a methodical process that ensures every decision you make is backed by real data and is designed to bring your CPA down over the long haul, not just for a few hours.

From Reactive Chaos to Proactive Control

The whole point of a daily system is to shift from making chaotic, gut-driven decisions to proactive, structured ones. Instead of waking up and asking, "What should I do today?" you follow a clear process that gives you a prioritized list of actions based on meaningful performance shifts.

This systematic approach helps you spot major issues like creative fatigue or audience saturation long before they torpedo your budget. You’re no longer just watching the storm roll in; you’re steering the ship with confidence.

Key Takeaway: A daily management system isn't about doing more every day. It's about having the clarity to know what needs your attention and—just as important—what needs to be left alone to optimize.

This is exactly where a modern execution system can make all the difference. Platforms like SpendOwlAI are built to provide this daily clarity. They analyze performance data for you and deliver a ranked list of actions with clear reasoning, helping you focus on the changes that will actually move the needle.

The Core Components of a Daily CPA Check-In

A solid daily check-in isn't about looking at every single metric under the sun. It's about quickly scanning for specific warning signs and opportunities in a structured way.

Your daily routine should include a quick review of:

Significant CPA Shifts: Don't just look at the last 24 hours. Check performance over a 3-day or 7-day rolling window. Is that high CPA a one-day blip or the start of a worrying trend?

Creative Fatigue Indicators: Is your ad frequency climbing while your Click-Through Rate (CTR) is dropping? That’s a classic sign your audience has seen your ad one too many times.

Audience Saturation: Keep an eye on your reach and audience penetration. If you’re just hammering the same small group of people, your costs are guaranteed to rise.

Budget Pacing: Are your campaigns blowing through their daily budget by noon, or are they struggling to spend at all? This can point to problems with your bids or targeting.

Implementing Guardrails to Protect Performance

A crucial part of any daily system is setting up "guardrails"—basically, rules and alerts that stop you from making common, expensive mistakes. These are your automated safety nets.

For example, you could set up alerts for:

Over-Editing: A guardrail can flag if you've made too many big edits to a campaign in a short time, which can throw the algorithm's learning into chaos.

Premature Scaling: An alert can warn you against dumping more budget into a campaign that hasn't proven it can perform stably and profitably yet.

Context Blindness: Guardrails can highlight when a campaign's CPA is climbing because of external factors, like higher auction competition (rising CPMs), so you don't blame a perfectly good ad.

By building this disciplined, systematic approach, you turn CPA management from a source of daily stress into a powerful engine for profitable growth. This is especially vital on complex platforms, and you can learn more about how to improve Google Ads performance with a structured approach in our detailed guide.

Your Top CPA Questions, Answered

Once you get the hang of the basics, the real questions start popping up. You know, the ones that come up when you're actually in the ad account trying to make things work. Let's tackle some of the most common head-scratchers e-commerce marketers face when it comes to Cost Per Acquisition.

What’s a Good Cost Per Acquisition for My E-commerce Store?

This is the million-dollar question, but the answer isn't a single number. A "good" CPA is completely unique to your business because it all comes down to your profit margins. The goal isn't just to get customers; it's to get them profitably.

A great place to start is to make sure your CPA is lower than the profit from a customer's first purchase. For instance, if your Average Order Value (AOV) is $100 and your gross margin is 40%, you’re making $40 in profit per order. In that case, any CPA under $40 means you're making money from day one.

But for a more sustainable, long-term view, a healthy ratio of Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) is 3:1. This means that over their entire relationship with your brand, a customer should be worth at least three times what you paid to acquire them.

The best marketing strategies are built on a solid CPA-to-LTV ratio. This is how you make sure you’re acquiring customers who bring real, long-term value, not just the ones who were easy to convert.

How Often Should I Check and Optimize My CPA?

It's tempting to refresh your ad manager every hour, but try to resist the urge to make knee-jerk changes. Ad platform algorithms need time—usually 3-7 days—to find their footing, especially after you’ve just launched something new or made a big change.

For campaigns that are already up and running smoothly, a weekly check-in is a good rhythm. If you tinker too often, you risk constantly resetting the platform's learning phase, which can do more harm than good. The real skill is learning to tell the difference between normal daily ups and downs and a genuine trend that needs your attention.

My CPA Suddenly Spiked! What Should I Check First?

First off, don't panic. When your CPA shoots up out of nowhere, it's time to put on your detective hat and work through a checklist.

Look Outside Your Account: Is it a holiday? Did a competitor just launch a massive sale? Sometimes, the reason has nothing to do with your campaigns and everything to do with what's happening in the market.

Diagnose Internal Issues: The usual suspects are creative fatigue (your ads are getting stale) or audience saturation (you've hit the same people one too many times).

Dig into the Metrics: Check your ad frequency and click-through rate (CTR). If frequency is climbing while CTR is dropping, that’s a classic sign your creative is tired. Also, take a peek at your CPMs to see if the ad auction is getting more expensive.

Check Your Tech: Finally, make sure nothing is broken. A buggy landing page, a misfiring tracking pixel, or a glitch in your checkout flow can kill conversions and send your CPA through the roof.

Should I Use a CPA Goal or a ROAS Goal?

The smartest advertisers use both. They might seem similar, but they help you balance two different, equally important objectives: efficiency and profitability.

Think of a CPA goal as your tool for controlling acquisition volume—it helps you get new customers in the door at a consistent cost. A ROAS (Return On Ad Spend) goal, on the other hand, makes sure the revenue you're bringing in from those new customers is actually profitable.

For example, you could set a CPA target on your prospecting campaigns to acquire new customers efficiently. Then, for your retargeting campaigns, you could switch to a minimum ROAS target to maximize profit from shoppers who are already close to buying. ROAS is especially powerful if you sell products at different price points, because it understands that a $200 sale is far more valuable than a $20 sale—something a simple CPA target can't do.

Managing your Cost Per Acquisition requires a system, not just guesswork. SpendOwlAI offers a daily execution system that cuts through the noise of ad data to give you clear, ranked actions. It helps you spot creative fatigue before it hurts, avoid scaling too soon, and make decisions backed by data. Stop reacting and start executing with confidence. Learn more and start your free trial today.